Crypto Trading Bots 2024 - 7 Best Trading Bots

Cryptocurrency trading is not simple anymore. Well, it never was – but now it’s so complex regarding software usage, that a simple newcomer is usually totally lost in what to do and what to use.

When you only start trading with crypto signals, you may definitely need some help opening orders quickly, tracking your progress, managing a portfolio, following crypto prices, etc. You could, of course, use excellent time management and a trader journal, but why?

Crypto trading bots can offer solutions to all your problems, which will save you time and help you avoid missing a stop loss or a target price. Trading bots offer auto trading, and below I am going to tell you almost everything I know about these cool guys. Also, you will be able to check the list of the best crypto trading bots and choose the one that’ll work for you. Or maybe a couple of them.

What Are Crypto Trading Bots?

Crypto trading bots are automated software programs designed to execute cryptocurrency trading strategies on behalf of crypto traders. Many trading bots use pre-defined algorithms and rules to analyze market data, identify potential trading opportunities, and execute trades without requiring constant manual intervention.

As I’ve already said, as soon as you launch trading bots, they can help you with many trading issues, especially if you use trading signals. The list below will explain to you how they can ease your trading and how crypto trading bots work.

- Data Analysis: Advanced crypto trading bots gather and analyze real-time market data from various sources, such as price charts, order books, and news feeds.

- Strategy Implementation: Traders can set specific trading strategies and parameters for the bot to follow. These strategies can range from simple ones like buying a cryptocurrency when its price reaches a certain level, to more complex strategies involving advanced trading indicators, moving averages, and trend analysis.

- Decision Making: Based on the chosen strategy and market analysis, the bot makes decisions on whether to buy, sell, or hold specific cryptocurrencies.

- Automated Execution: Once a trading signal is generated according to the strategy, the bot automatically executes the trade on the user’s behalf. This can involve placing buy or sell orders on cryptocurrency exchanges.

- 24/7 Operation: One of the main advantages of crypto trading bots is that they can operate around the clock, taking advantage of market opportunities even when the trader is not actively monitoring the markets and can not follow trading signals.

- Reduced Emotion and Human Error: Automated trading bots execute trades based on predefined rules and data analysis, removing the emotional aspect of trading and reducing the likelihood of human errors caused by fatigue or emotions to achieve profitable trades at multiple crypto exchanges.

Pros and Cons of Crypto Trading Bots

Pros

24/7 Trading: Trading bots operate around the clock, executing trades even when the trader is asleep or unavailable. This ensures that trading opportunities are not missed.

Emotion-Free Trading: Bots execute trades based on predefined rules and algorithms, eliminating the emotional bias that can lead to poor decision-making in trading.

Speed and Accuracy: Bots can execute trades with lightning speed and accuracy, reducing the risk of missed opportunities or errors due to human limitations.

Multiple Strategy Execution: Bots can execute a variety of trading strategies simultaneously, allowing users to diversify their portfolio and explore different market opportunities.

Backtesting: Many bots offer backtesting features, allowing users to test their strategies using historical data before deploying them in real-time trading.

Consistency: Bots stick to their programmed rules consistently, reducing the likelihood of inconsistent decision-making that can come from human emotions.

Diversification: Automated bots can manage multiple trading pairs and strategies simultaneously, providing efficient diversification in the portfolio.

Learning Opportunity: Observing how a bot operates can help traders, especially beginners, learn about different trading strategies and market dynamics.

Cons

Technical Issues: Cryptocurrency trading bots can encounter technical glitches or connectivity problems, which can lead to missed trading opportunities or unintended actions.

Algorithm Dependence: A trading bot platform is only as effective as the algorithm it’s based on. Poorly designed algorithms can lead to losses, and users need to have a strong understanding of trading concepts to design effective algorithms.

Market Manipulation: In some cases, traders may manipulate markets to trigger bot trading responses and take advantage of automated trading strategies.

Over-Reliance: Relying solely on cryptocurrency trading bots without understanding the underlying strategies can hinder traders from developing their own trading skills and insights.

How We Review Bots

It goes without saying that crypto trading bots require more time to get our final opinion – we need to get deeper here. I am not going to explain you boring software details that our team takes into account, but I will sure tell you a step-be-step process.

Anyway, if you decide to choose the AI crypto trading bot from our list, you can rest asured that our team is confident that this trading bot is secure for your trades.

#1 – Registration & General Information

We start with checking all the reviews available on the Internet to decide if the bot actually worth our time. I should tell you that we don’t have a lot of examples when we don’t even want to create an account at a trading bot. Very often, when the automated crypto trading bot doesn’t have reviews, it mean that it’s new.

So, as soon as we checked the reviews and our tech team checks the trading bot’s Github, we create an account to trade crypto – which is quite quick, crypto bots usually require an email and your name.

#2 – Reviewing Features using Our Trading Strategy

This is the main step because we want everything to go smoothly for you. Our expert, or very often a couple of them, check the trading bot’s setting using different trading strategies and crypto exchanges. Then, based on our impressions, we write a dedicated review so you know what to expect from the crypto trading bot.

#3 – Setting the Final Score

As soon as my colleagues are done with review, we sum up everything to give a rank for the bot. The bots you see higher on our list managed to give more benefits for crypto trading. The ones that are below are usually less beneficial or more complex to use.

Best Crypto Trading Bots 2024 – Overview

| Trading bot | Features | Pricing |

| 3Commas |

|

|

| CryptoHopper |

|

|

| Cornix |

|

|

| Shrimpy.io |

|

|

| Zignaly |

|

|

Types of Crypto Trading Bots

There are a lot of different types of crypto trading bots. Some of them, like Cornix, operate on Telegram or another messenger only. While other are the best for portfolio management or complex trading strategies.

So, let’s check what types of advanced trading bots you can meet.

Trend Following Bots

Many crypto trading bots are programmed to identify and follow trends in the cryptocurrency markets. They aim to capitalize on upward or downward price movements by buying during uptrends and selling during downtrends on major exchanges.

Arbitrage Trading Bots

An arbitrage trading bot exploits price differences for the same cryptocurrency across different exchanges. A spot/futures arbitrage bot buys the cryptocurrency from an exchange where the price is lower and simultaneously sells it on an exchange where the price is higher, thereby profiting from the price disparity.

Market Making Bots

Market making bots provide liquidity to the market by placing both buy and sell orders around the current market price. They profit from the spread between the bid and ask prices. These crypto bots are commonly used in more liquid markets.

Mean Reversion Bots

Mean reversion bots operate on the premise that prices tend to revert to their historical average over time. These crypto bots buy when prices are significantly lower than their historical average and sell when prices are significantly higher.

Sentiment Analysis Bots

These bots analyze social media posts, news articles, and other sources of sentiment data to gauge the overall market sentiment. Based on positive or negative sentiment, they may adjust trading strategies.

Algorithmic Trading Bots

Algorithmic bots use complex mathematical algorithms to analyze market data and execute trades. These algorithms can be highly customized and can involve various technical indicators and patterns.

Machine Learning Bots

Machine learning bots use artificial intelligence and machine learning techniques to adapt their strategies based on historical data and current market conditions. They can learn from their own performance and adjust their trading strategies accordingly.

Copy Trading Bots

These bots allow crypto traders to copy the trades of experienced traders. Users can choose a trader to follow, and the bot will replicate their trading actions in the user’s account.

Scalping Bots

Scalping bots aim to profit from small price movements by making rapid buy and sell trades within short time frames. They often execute a large number of trades in a single day.

Hedging Bots

Hedging bots are used to reduce risk by entering trades that offset potential losses in other positions. They can be used to protect against sudden market downturns.

How Can Crypto Trading Bots Help?

As a beginner in the world of cryptocurrency trading, navigating the 24/7 markets and making informed decisions can be quite overwhelming. This is where crypto trading bots can step in to lend a helping hand. Let’s explore how these bots can be a valuable resource for traders like you.

? Constant Vigilance, Even While You Rest

Cryptocurrency markets never sleep, and staying glued to price charts around the clock isn’t practical. With a trading bot, you don’t have to worry about missing out on potential trading opportunities, as it tirelessly monitors the markets and executes trades on your behalf, even when you’re catching up on much-needed sleep.

Imagine setting up a trend-following bot that automatically buys a cryptocurrency when its price crosses above a moving average. This strategy helps you capture upward trends without having to be glued to your screen.

? Cool Calculations Over Emotional Reactions

Emotions can often cloud judgment, leading to impulsive decisions that might not be in your best interest. AI crypto trading bots, on the other hand, operate based on logical algorithms and preset rules, eliminating emotional bias from the equation. This can be a huge advantage, especially for beginners who might struggle with keeping emotions in check during turbulent market moments.

Let’s say you’re intrigued by technical analysis but find it challenging to identify the right entry and exit points. You could use a bot that considers a combination of indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) to trigger trades. When these indicators align favorably, the bot executes the trade, saving you from the complexity of manual analysis.

? Protector of Portfolios

Risk management is crucial in trading, but it’s not always easy to stick to your plans when emotions come into play. An AI trading bot ensures that your predetermined stop-loss and take-profit levels are adhered to, helping you protect your investments and avoid larger losses.

If you’re more interested in long-term holding than frequent trading of coins with high trading volume, a bot could be set up to make occasional purchases of a particular cryptocurrency at specific price levels. This strategy aims to accumulate the asset over time, taking advantage of potential price dips.

?? Diversification Made Simple

Balancing multiple trading pairs manually can be complex, especially for beginners. Trading bots can handle multiple pairs simultaneously, allowing you to diversify your portfolio without needing to constantly monitor each individual pair.

As a beginner in trading crypto, maintaining a balanced portfolio can be challenging. A portfolio rebalancing bot monitors your portfolio’s allocation and automatically adjusts it back to your desired proportions. For example, if a certain cryptocurrency’s value increases, the bot would sell some of it to maintain your preferred asset distribution.

? Learn as You Observe

Observing how a trading bot navigates the market can be a valuable learning experience. You can see how it reacts to different market conditions, gaining insights into various trading strategies along the way.

5 Best Crypto Trading Bots

I hope now you know enough about crypto trading bots to finally check our top list. Below, I am going to tell you about 5 best trading bots, and you can can choose the most suitable trading bot for your trading strategy.

3Commas – The Best Trading Bot for Trading on Multiple Exchanges

3Commas is a powerful crypto trading bot that offers a range of advanced trading tools and services to assist traders in managing their cryptocurrency investments. It is designed to help both beginners and experienced traders navigate the complexities of the cryptocurrency market. Here are some key features and aspects of 3Commas trading bot:

#1 – Smart Trade Terminal: The trading bot provides a user-friendly interface known as the Smart Trade Terminal. It enables users to place manual trades across multiple cryptocurrency exchanges from a single dashboard. This is particularly useful for traders who want to actively manage their trades without needing to switch between different exchange platforms.

#2 – Copy Trading: 3Commas offers a copy trading feature that allows crypto traders to follow and replicate the trading strategies of more experienced traders. This can be beneficial for beginners who want to learn from successful traders and potentially earn profits by mirroring their trades.

#3 – Portfolio Management: The platform includes tools for managing and tracking the performance of your cryptocurrency portfolio. Users can monitor their holdings across various exchanges and wallets in one place.

#4 – TradingView Integration: 3Commas integrates with TradingView, a popular charting and technical analysis platform. This integration allows users to access advanced charting tools and technical indicators for making informed trading decisions.

#5 – Paper Trading: 3Commas provides a paper trading feature that allows users to practice their trading strategies in a simulated environment without risking real funds. This is a valuable tool for beginners to test their strategies before committing actual capital.

Subscription Plans of 3Commas Trading Bot

- Free Plan – 0 USD (includes Portfolio Tracking and Unlimited Scalper Terminal);

- Starter – 29 USD/month (includes One GRID Trading Bot, One DCA Bot, One Smart Bot, Unlimited HODL Bot, One Options Bot, Unlimited Active SmartTrades, Unlimited Scalper Terminal, and a Demo Account);

- Advanced – 49 USD/month (includes One GRID Bots, Unlimited DCA Bots, One Smart Bot, Unlimited HODL Bot, One Options Bot, Unlimited Active SmartTrades, Unlimited Scalper Terminal, and a Demo Account);

- Pro – 99 USD/month (includes unlimited offers of all of the features from Advanced Plan, except for the Options Bot – in Pro account, you get one as well).

CryptoHopper – The Best Trading Bot for Backtesting Your Strategies

CryptoHopper is another popular crypto trading bot that offers automated trading solutions for both beginner and experienced traders. Similar to 3Commas, CryptoHopper aims to simplify the process of trading cryptocurrencies by providing tools and features to help users implement trading strategies and manage their investments. Here’s an overview of CryptoHopper:

#1 – Marketplace of Strategies: Users can access and utilize a marketplace of pre-configured trading strategies created by other traders. This allows beginners to leverage the expertise of more experienced traders and implement proven strategies.

#2 – Customizable Strategies: Users can also create their own trading strategies using CryptoHopper’s user-friendly strategy designer. This feature enables traders to tailor their bots to their specific preferences and risk tolerance.

#3 – Technical Analysis Tools: The platform integrates with technical analysis tools and indicators, allowing users to make informed decisions based on price charts and market trends.

#4 – Backtesting: CryptoHopper offers backtesting functionality, enabling users to test their trading strategies using historical market data. This can help users assess the performance of their strategies before deploying them in real-time trading.

#5 – Paper Trading: Similar to 3Commas, CryptoHopper offers a paper trading feature that allows users to practice trading strategies in a simulated environment before committing real funds.

#6 – DCA (Dollar-Cost Averaging) Bots: CryptoHopper includes bots that facilitate dollar-cost averaging, allowing users to accumulate a cryptocurrency over time by making regular, fixed-size purchases.

Subscription Plans of CryptoHopper Trading Bot

- Pioneer – 0 USD (includes 20 open positions per exchange, Portfolio Management, and a free manual trading on all exchanges);

- Explorer – 19 USD/month (includes 80 open positions per exchange, backtesting, Strategy Designer, Paper Trading, etc.);

- Adventurer – 49 USD/month (includes everything from Explorer Plan, and 200 open positions per exchange, 5 event-based triggers, scan markets with the power of 50 bots, etc.);

- Hero – 99 USD/month (includes everything from the Adventurer Plan + some more advanced features, which you can check below).

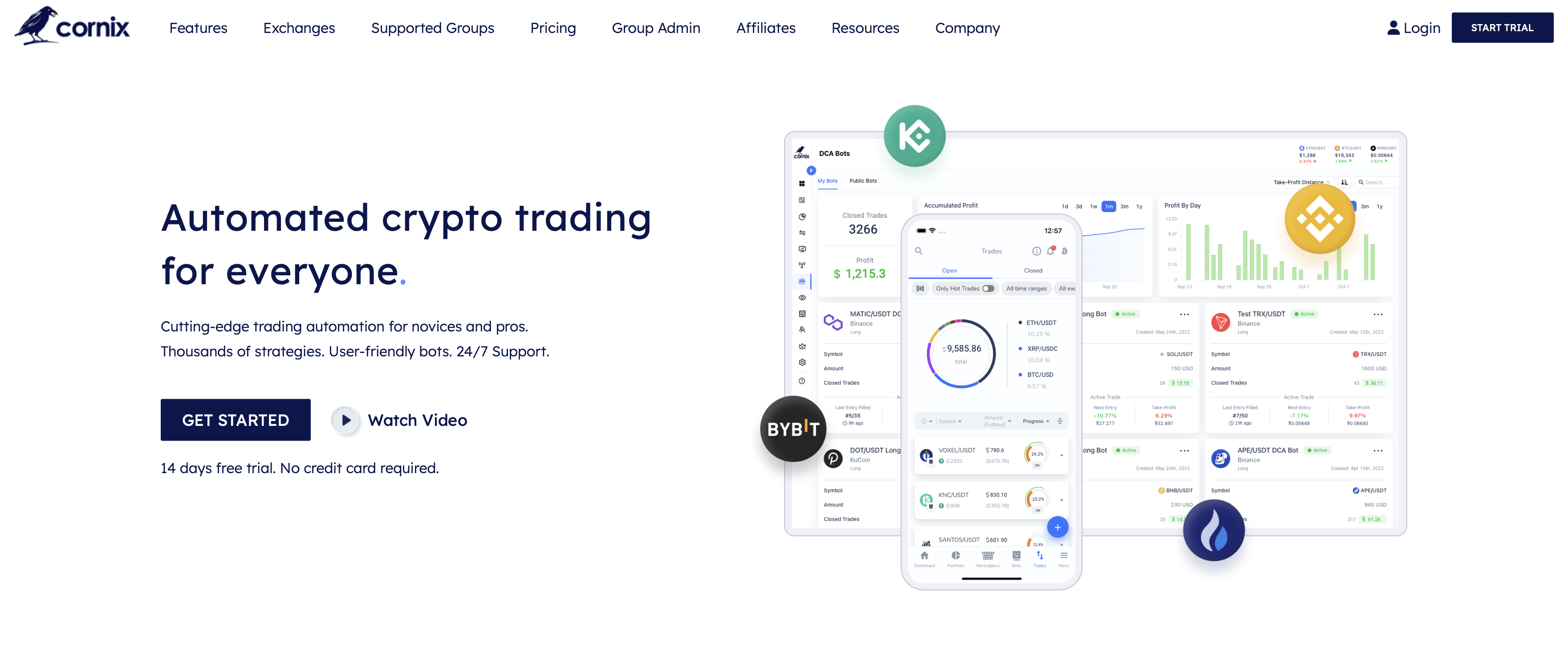

Cornix – The Best Trading Bot for Crypto Signals

Cornix is a cryptocurrency trading bot that specializes in providing automated trading solutions for the crypto market. It’s designed to assist traders in executing their trading strategies without the need for constant manual intervention. Cornix is known for its ease of use and integration with popular cryptocurrency exchanges. You can get a free trial version before purchasing a plan. Here’s an overview of Cornix:

#1 – Telegram Integration: Cornix operates primarily through Telegram, a popular messaging app. Users can interact with their bots, monitor trades, and receive notifications through the Telegram interface.

#2 – Customizable Strategies: Users can customize their trading strategies based on factors such as entry points, stop-loss levels, take-profit levels, and risk management parameters.

#3 – Risk Management: Cornix includes risk management features such as setting stop-loss and take-profit levels, which help users manage potential losses and secure profits.

#4 – Trailing Stop-Loss: The trading tool supports trailing stop-loss orders, which automatically adjust based on price movements. This helps users protect profits while allowing room for potential gains.

#5 – Paper Trading: Like other platforms, Cornix offers paper trading functionality, allowing users to practice their strategies in a simulated environment before trading with real funds.

Subscription Plans of Cornix Trading Bot

- Beginner – 29,90 USD/month (includes manual trading, Telegram bot integration, trading notifications, trailing functionality, concurrent stop, customer support and 2 primary API slots);

- Intermediate – 39,90 USD/month (includes everything from the Beginner Plan, and an automatic signal following additionaly);

- Pro – 59,90 USD/month (includes everything from the Intermediate Plan, and a mobile app, web interface, TradingView integration, DCA bots, a trading terminal).

Shrimpy.io – The Best Trading Bot for Your Crypto Portfolio Automation

Shrimpy is a crypto trading bot and a social trading platform that offers a range of tools and features to help users manage their cryptocurrency investments and trading strategies. It’s designed to simplify the process of tracking, rebalancing, and automating cryptocurrency portfolios. Also, you can check this bot by requesting a free trial. Here’s an overview of Shrimpy:

#1 – Portfolio Management: Shrimpy allows users to create and manage cryptocurrency portfolios by selecting a diverse range of assets. Users can track the performance of their portfolios and monitor asset allocations.

#2 – Automated Rebalancing: One of the standout features of Shrimpy is its automated portfolio rebalancing. Users can set target percentages for each asset in their portfolio, and Shrimpy will automatically rebalance the portfolio back to these targets at regular intervals.

#3 – Social Portfolios: Shrimpy enables users to follow and replicate portfolios created by other users. This social aspect allows beginners to benefit from the expertise of experienced traders by mirroring their portfolio allocations.

#4 – Backtesting: Users can backtest their portfolio strategies using historical market data to see how different allocations would have performed over time.

#5 – Dollar-Cost Averaging (DCA): Shrimpy supports dollar-cost averaging, where users can set up recurring purchases of a specific cryptocurrency at regular intervals.

Subscription Plans of Shrimpy.io Trading Bot

- Free – 0 USD/month (includes unlimited spot trades, 3 backtests per day, 1 supported exchange, 1 portfolio to manage, etc.);

- Standard – 19 USD/month (includes everything from the Free Plan, with 5 supported exchanges, 5 portfolios to manage, 25 backtests per day, portfolio DCA, dynamic indexing, etc.);

- Plus – 49 USD/month (includes everything from the Standard Plan and every feature available).

Zignaly – The Best Crypto Trading Bot for Beginners

Zignaly is an automated trading platform and a crypto trading bot that offers automated trading solutions for both beginner and experienced traders. The platform aims to simplify the process of trading cryptocurrencies by providing tools and features that allow users to implement and execute a crypto trading strategy automatically. Here’s an overview of Zignaly:

#1 – Copy Trading: One of the notable features of Zignaly crypto bot is its copy trading functionality. Users can follow and replicate the trades of experienced traders, allowing beginners to potentially profit while learning from experts.

#2 – TradingView Integration: Zignaly integrates with TradingView, a popular charting and technical analysis platform. This integration allows users to access advanced charting tools and technical indicators to aid their trading decisions.

#3 – Customizable Strategies: Users can customize their crypto trading strategies based on factors such as entry and exit points, stop-loss levels, take-profit levels, and more.

#4 – Risk Management: Zignaly includes risk management features like setting stop-loss and take-profit levels, helping users manage potential losses and secure profits.

#5 – Paper Trading: Similar to other crypto trading bots, Zignaly offers a paper trading feature that allows users to practice their strategies in a simulated environment before committing real funds.

Subscription Plans of Zignaly Trading Bot

Zignaly crypto trading bot does not collect monthly fees – you pay the fees from your final earnings. This is one more reason our team recommends this crypto bot trading for newcomers – they can try everything before spedning money on a service. You can basically consider it a free crypto trading bot.

Are There Scam Crypto Trading Bots?

Yes, there have been instances of scam trading bots in the cryptocurrency market. Scammers often take advantage of the growing interest in cryptocurrency trading and the allure of automated trading solutions to deceive unsuspecting traders. These scam trading bots promise unrealistic profits, use deceptive marketing tactics, and may request users’ personal and financial information.

If you are looking for an example, I am prepared! Here is the list of scam bots from before:

- Bitconnect: Bitconnect was a widely known cryptocurrency lending and trading bot that turned out to be a Ponzi scheme. It promised users high daily returns through a lending program and its own trading bot. However, it collapsed in 2018, resulting in significant losses for investors.

- LoopX: LoopX claimed to offer a revolutionary trading algorithm that would generate substantial profits for investors. It collected millions of dollars from investors through an initial coin offering (ICO) but disappeared abruptly in early 2018, leaving investors with empty promises.

- GAW Miners and ZenMiner: These platforms operated as cloud mining and trading services, offering users the opportunity to mine cryptocurrencies and trade using their services. However, they were later revealed to be Ponzi schemes, resulting in legal actions and financial losses for participants.

To avoid falling victim to scam trading bots, thoroughly research any platform you’re considering using. Look for reviews from reputable sources, seek recommendations from trusted traders, and verify the platform’s legitimacy through multiple sources. Additionally, if an offer sounds too good to be true, it likely is. Exercise skepticism and always prioritize security when dealing with any financial service in the cryptocurrency space.

Crypto Trading Bots – Final Thoughts

Crypto trading bots have revolutionized the way traders interact with the dynamic and 24/7 crypto markets. These automated tools offer the potential for enhanced efficiency, emotion-free trading, and access to a wide range of strategies. They can be particularly beneficial for both beginners looking to learn and experienced traders seeking to optimize their trading processes.

However, it’s essential to approach trading bots with caution and a solid understanding of both the platform’s features and the underlying market dynamics. While they offer advantages such as continuous trading, backtesting, and portfolio diversification, they also carry risks like technical glitches, algorithmic limitations, and vulnerability to unpredictable market events.

As with any trading endeavor, a balanced approach is key. Combining the power of automated trading with a solid foundation of trading knowledge, risk management, and continuous market analysis can empower traders to make informed decisions and harness the potential benefits of cryptocurrency trading bots while mitigating potential drawbacks.

Frequently Asked Questions

Learn how to get started