Making informed decisions when buying, selling, and investing in cryptocurrencies can be achieved through trading crypto signals. But, success depends on selecting the appropriate exchange. We’ll examine the top 3 cryptocurrency exchanges in this evaluation along with the advantages they provide for trading crypto signals.

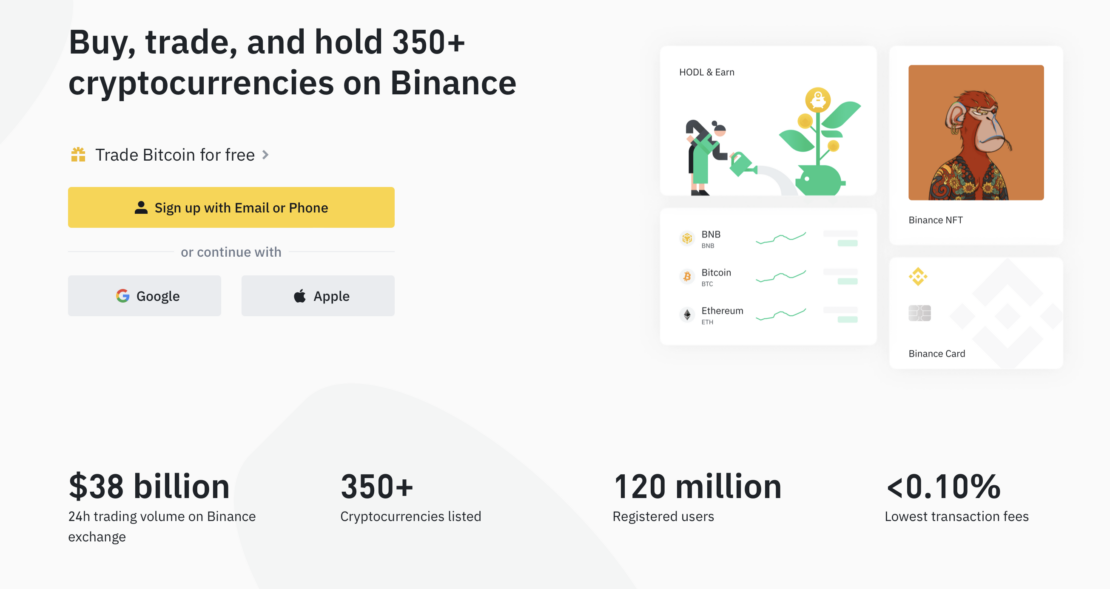

Binance: The Global Powerhouse

As one of the biggest and most prosperous cryptocurrency exchanges in the world, Binance provides a straightforward platform with a wide selection of virtual goods. It is a great option for trading cryptocurrency signals because of its sophisticated trading tools, strong security features, and global reach. Visit our Binance crypto signals page for more details.

Benefits:

- A comprehensive selection of cryptocurrencies provides opportunities to diversify your portfolio.

- Advanced trading tools, such as stop-limit orders and margin trading, help execute trades based on crypto signals effectively.

- Binance Smart Chain is an innovative blockchain platform that facilitates the creation of decentralized applications and token offerings, offering new investment opportunities.

Coinbase: The User-Friendly Gateway

Coinbase is a well-liked option for both novice and seasoned traders due to its user-friendly interface and dedication to regulatory compliance. The setting is suitable for trading crypto signals on Coinbase because of its uncomplicated trading philosophy and robust security features.

Benefits:

- Easy-to-use platform, making it simple for traders to execute trades based on crypto signals.

- Educational resources, such as Coinbase Earn and the Coinbase Blog, help users stay informed and make better-informed decisions.

- Strong security measures, including two-factor authentication and offline storage of customer funds, provide peace of mind when trading.

Kraken: The Security-First Pioneer

With a large selection of cryptocurrencies and cutting-edge trading tools, Kraken has established a reputation as a security-focused and incredibly dependable exchange. It is a dependable option for trading crypto signals due to its focus on compliance and open operations.

Benefits:

- A strong commitment to security, ensuring that user funds and data are well-protected.

- Advanced trading tools, such as futures and margin trading, help traders capitalize on crypto signals.

- Transparent fee structure and commitment to regulatory compliance, fostering trust and credibility.

7 Tips on Choosing the Best Crypto Exchange

Selecting the right crypto exchange is crucial for a successful trading experience in the field of crypto signals. Check 7 tips that will help you choose the best cryptocurrency exchange not only for trading but for storing your assets.

- Security: Make sure the crypto exchange uses strong security measures, such as two-factor authentication (2FA), cold storage, and encryption techniques. Don’t deposit your assets and give personal information unless you are sure the exchange is legit.

- Fees: Examine the exchange’s fee structure, including trading fees, deposit and withdrawal fees, and any hidden charges. Look for a platform with transparent and competitive fees to maximize your returns.

- Trading Pairs: Consider the number of trading pairs offered by the exchange, especially if you’re interested in trading altcoins. A wider range of trading pairs provides more opportunities and flexibility for your trading strategies.

- User Experience: Choose a platform that has a simple, user-friendly interface. You will find it simpler to use the platform, place orders, and effectively manage your trades as a result.

- Customer Support: A responsive and knowledgeable customer support team is invaluable. Check for the availability of live chat, email support, or phone support, and read user reviews to gauge the quality of the exchange’s customer service.

- Liquidity: High liquidity ensures that you can execute trades quickly and at the desired price. Exchanges with greater liquidity typically have tighter spreads, which can help reduce your trading costs.

- Regulatory Compliance: Choose an exchange that complies with relevant regulations in your jurisdiction. This indicates a commitment to transparency, security, and the protection of users’ interests.